27+ mortgage down payment loan

In addition your down payment amount your credit score credit history total debt and annual income will influence how much of a loan you can qualify for. Ad Apply today for a USDA home loan.

Down Payment Calculator How Much Should You Put Down

Take the First Step Towards Your Dream Home See If You Qualify.

. Web A range of low-down-payment mortgages and down payment assistance programs can unlock homeownership for people who lack substantial savings but can afford monthly house payments. Web Our Zero Down mortgage program pairs a standard FHA first mortgage for up to 965 percent of the total purchase price plus second mortgage options to go toward down payment andor closing costs. Comparisons Trusted by 55000000.

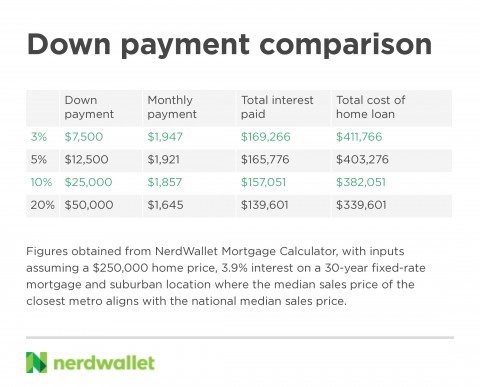

Web A down payment is the amount of money you spend upfront to purchase a home and is typically combined with a home loan to fulfill the total purchase price of a home. If the down payment is lower than 20 borrowers will be asked to purchase Private Mortgage Insurance PMI to protect the mortgage lenders. Some loans like VA loans and some USDA loans allow zero down.

For first-time homebuyers the average down payment is just 7. Web A 20 down payment isnt the only way to get a mortgage. The second mortgage provides down payment assistance of 35 percent of the purchase price as a repayable lien.

Apply for Your Mortgage Now. Your loan-to-value equation would look like this. Find A Lender That Offers Great Service.

FHA loans which are backed by the Federal Housing Administration require as little as 35 down if you have a credit score thats at least 580. Depending on the exact down payment assistance program a Community Second Mortgage offers a variety of repayment options. But the amount you need can vary widely.

Check Your Official Eligibility. Lock Your Rate Today. Compare Rates of Interest Down Payment Needed in Seconds.

Join thousands of rural homebuyers who save every year with the benefits of a USDA loan. Some lenders may require a minimum down payment of 25 or even 30. The good news is you dont have to feel limited by these figures.

Web One FannieFreddie program many lenders use is a loan that allows first time buyers or buyers who havent owned a home in the past three years to put just 3 percent down on loans up to 417000 which equates to a home purchase price up to 430000. Ad 10 Best House Loan Lenders Compared Reviewed. Interest-free loans which have to.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Loans which have less than 20 down-payment have a loan-to-value LTV above 80 are required to carry property mortgage insurance PMI which is an additional expense paid by the home buyer to insure the lender will get paid in case the homeowner can not make payments. Ad Calculate Your Payment with 0 Down.

Comparisons Trusted by 55000000. Zero-down mortgages can open doors to homeownership for buyers with limited savings and free up cash for expenses such as closing. Take the First Step Towards Your Dream Home See If You Qualify.

Ad Updated FHA Loan Requirements for 2023. Repeat buyers put down an average of. It is also important to consider that FHA loans require that you have mortgage insurance for the life of the loan and they do not include an adjustable-rate option.

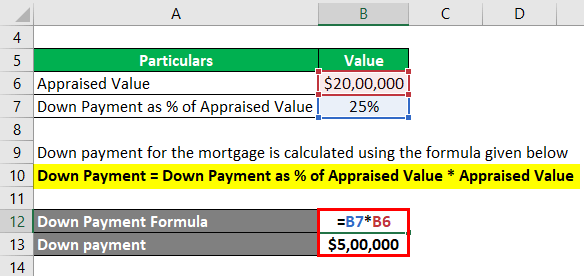

Ad Realize Your Dream of Having Your Own Home. Loan amount - If youre getting a. You multiply 80 by 100 and that gives you an LTV of 80.

160000 200000 80. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web The main benefits of an FHA loan include term options of 15 or 30 years a down payment as low as 35 and eligibility for those with a slightly lower credit score.

If you have a credit score between 500 and 579 you. But the truth is different types of loans may each have their own set of requirements for a down payment and the. Ad A full range of mortgage programs to support any goal.

Web A Community Second Mortgage is a grant or loan that allows approved third parties to provide up to 105 of the homes value to cover the down payment and closing costs. Web Conventional loans normally require a down payment of 20 but some lenders may go lower such as 10 5 or 3 at the very least. If you have.

VA loans offer 100 financing for veterans and USDA loans provide the same for income. Ad 10 Best House Loan Lenders Compared Reviewed. A 0 interest rate on the second.

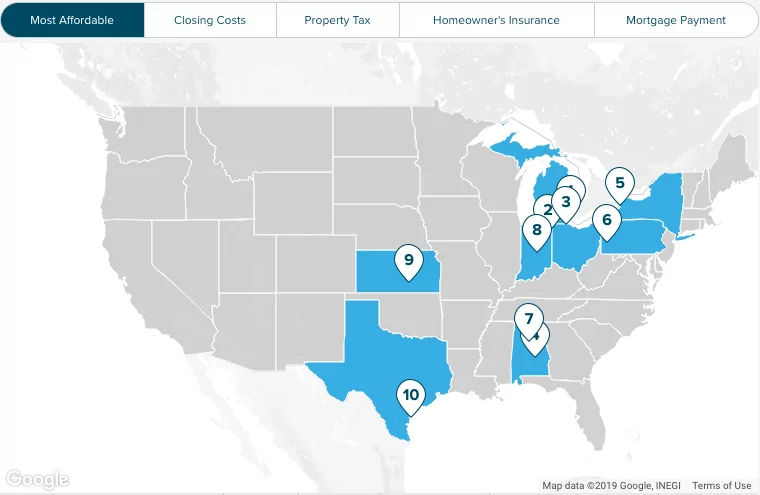

Web According to the 2019 Profile of Home Buyers and Sellers by the National Association of Realtors the median down payment for homebuyers is 12 of the purchase price which would be 24000 for a 200000 home for example. Ad Compare More Than Just Rates. Web The average down payment on a home is 12 according to the National Association of Realtors.

While a 20 down payment is a good benchmark its always best to talk to your lender about all options. Check Your Official Eligibility. The mortgage terms most commonly offered are 15 years and 30 years although you can also find 10- 20- and 40-year.

Apply now or contact our team. Your loan officer can provide. The down payment can come from family gift funds or your own money and you must live.

Interest-bearing loans set up as a second mortgage which the qualified homebuyer must repay. Web As low as 35 down payment mortgages. Web When picking a mortgage you should consider the loan term or payment schedule.

View Ratings of the Best Mortgage Lenders. Great selection of home loans. Web All conventional mortgage loans require a down payment.

Although its a myth that a 20 down payment is required to obtain a loan keep in mind that the higher your down payment the lower your monthly payment. Web The bank will base the loan amount on the 200000 figure because its the lower of the 2. Web Down payment - The down payment is money you give to the homes seller.

You may be eligible for 0 down and no PMI. Ad Updated FHA Loan Requirements for 2023. Web As a general rule of thumb you can expect to make a down payment of at least 10 on your jumbo loan.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Most home loans require at least 3 of the price of the home as a down payment. At least 20 percent down typically lets you avoid mortgage insurance.

Web While youre considering down payment gifts look at the down payment requirements for different loan types. Home buyers can make a conventional down payment anywhere between 3 and 20 or more. Web There are three major types of down payment assistance including.

Web FHA loans Backed by the Federal Housing Administration FHA an FHA loan requires only 35 percent down with a credit sore as low as 580. Lock Your Rate Today. Get Instantly Matched With Your Ideal Mortgage Lender.

You have 40000 for a down payment so you need a 160000 loan to meet the 200000 purchase price.

The Doctor Mortgage Loan Mortgage Pre Approval

:max_bytes(150000):strip_icc()/tips-for-buying-your-first-home-1798337-color-v02-d6b6a9f0efda4a0fa44fb23e7665ac7f.png)

How Much To Put Down On A House

The Mortgage Office Software Reviews Demo Pricing 2023

My Plan To Pay Off My Mortgage Early What Mommy Does

Loan To Value Ratio Example Explanation With Excel Template

Down Payment On A House How Much Do You Need

What Is A Mortgage The Ultimate Guide To Home Loans

27 Loan Agreement Formats Word Pdf Pages

Taylor Mortgage Group

Solved 15 Mortgage Payments Mortgages Loans Taken To Chegg Com

No Down Payment Mortgage Plus Delayed First Payment

Va Loan Eligibility

Hope Brings You Home Is Back For 2020

3 Down Payment Home Loans Dallas Richard Woodward

Downpayment Archives Hunt Real Estate Corporation Blog

Alex Szep Nmls 460231 New American Funding Alexszep Twitter

The Doctor Mortgage Loan Mortgage Pre Approval